Sendero Concept

In 2002, the Sendero shopping center concept and brand was launched with the opening of Plaza Sendero Escobedo in the state of Nuevo Leon, attesting Acosta Verde’s more than 30 years of experience in the planning, development, operation, and management of community shopping centers.

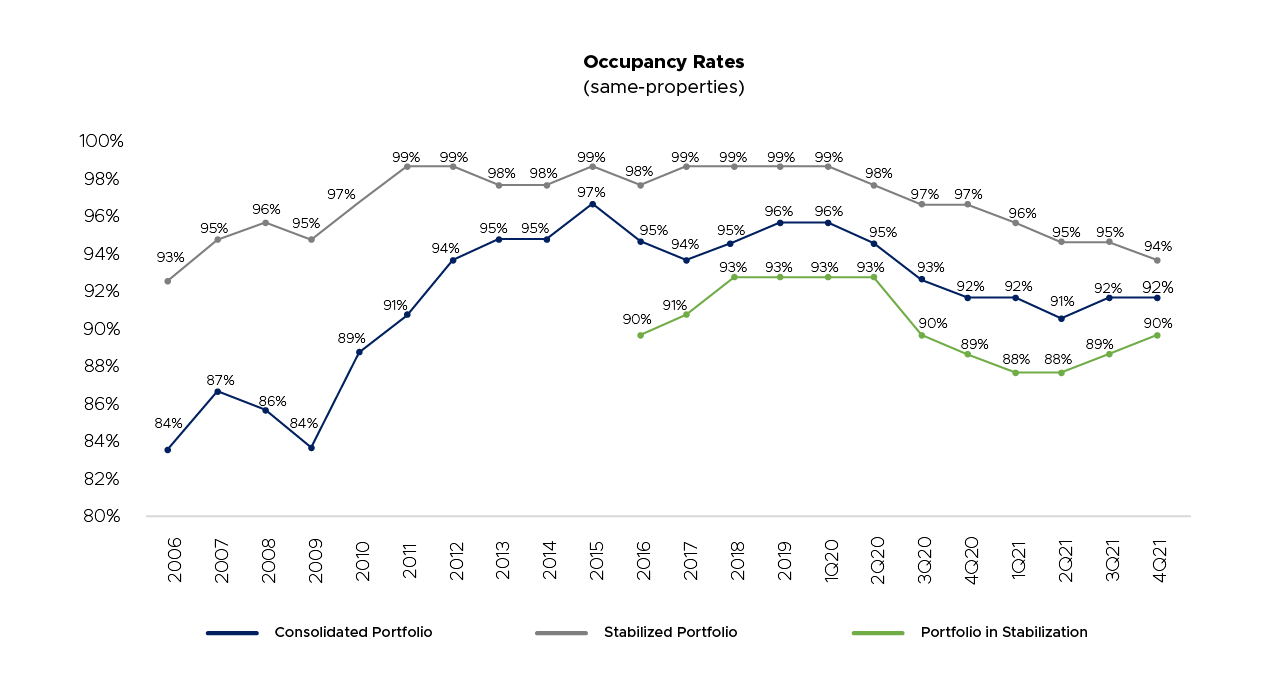

Throughout its history, the occupancy levels and visitor traffic have been benchmarks for the success of Sendero plazas, noted for their resilience in complex times such as the financial crisis of 2008-2009 and the current COVID-19 pandemic.

To meet the primary needs of Mexicans, Sendero was conceived as a concept that encompasses the key features of shopping and entertainment malls, while using self-service stores and multiplexes as anchors.

Taken together, these elements have enabled Acosta Verde to consolidate solid and lasting relationships with the most renowned brands in the country, positioning the Sendero model as a very attractive option for the main retailers in Mexico.

Exclusive Location

• Presence in major and strategic cities

• Located on main avenues, with high vehicle traffic, great visibility, and easy access for visitors

Retail Focus

• Essential business by satisfying consumption, leisure, entertainment, and service needs

• The target market comprises socioeconomic segments C y D+

• Location in metropolitan areas and strategic cities in Mexico where there is an under-penetration of community centers and with significant population growth

Shopping Experience

• Highest quality facilities

•Ongoing events, activities, and promotions to drive visitor traffic

• Free internet

• Loyalty plan to encourage recurring visits

Tenant Composition

• Constant tracking of the latest market trends

• Behavioral analysis of the target population

• Offering adapted to the findings of the two previous points to satisfy the entertainment social, and shopping needs of visitors.

Proven Results

• The quality of the Sendero model has been consolidated since it was launched, as all commercial centers operating under this brand boast high occupancy levels (target of at least 80% occupancy, without considering anchors), with predictable lease durations and revenue flow due to its long-term nature.

• High visitor traffic, which prior to the COVID-19 crisis was approximately over 100 million per year, while during 2021, when lockdown was eased, it reached more than 85 million.

•High renewal rates

Layout

• Below is a diagram that shows how the GLA is typically distributed at each Sendero shopping center, including by way of illustration selected brands that may be found at each one.

Operating Strategy

• Anchor stores and tenant composition are major drivers behind shopping center performance

• Strong focus on entertainment and leisure, including:

- Tenants with brands engaged in children’s and family entertainment as a fundamental component of the shopping center’s offering.

- Social events for all ages, such as concerts with famous artists

- Increased business hours of gyms and fitness centers

- Sendero is a community gathering point

• High occupancy rates since each opening, as ~50% of the GLA is leased to national chains, which have been with Acosta Verde in each new project.

• Social media marketing to attract new clients and strengthen the loyalty of current clients through tailormade experiences.

• Constant facilities maintenance, ensuring an efficient operation

• Special focus on safety and security

Physical Features

• Average space of 35,000 m2 on approximately 15 hectares of land plot

• Generally including the following:

- 1 supermarket

- 1 multiplex

- 4-5 department store

- 2-3 bank branches

- 2-4 stores (department stores, banks or restaurants) in stand-alone format in the parking area

- 4-6 stand-alone restaurants plus a food court

- 100 stores for entertainment, clothing, footwear, electronics, gyms, among others

• Air-conditioned and roofed spaces

• Secure environment designed to meet the shopping and entertainment needs of Mexico’s middle- and lower-middle income population

Properties

Since the launch of Plazas Sendero in 2002, Grupo Acosta Verde’s portfolio has continued to grow, comprising 18 properties as of December 31, 2021, with 17 in operation and 1 under development.

The Operating Portfolio is divided into 2 categories: i) the Stabilized Portfolio, comprised of shopping centers with an average age of 15.9 years, featuring high occupancy levels and stabilized revenue flows, in addition to eight sub-anchors acquired in 2017, whose established premises are in some of the Stabilized Shopping centers; and ii) Portfolio in Stabilization, made up of shopping centers opened as of 2016, with an average age of 4.0 years at the end of 2021.

The Portfolio under Development includes Sendero Ensenada, whose construction remains on hold until the epidemiological situation stabilizes and the Company considers that it resume its development while upholding the brand standards.

However, it is important to mention that we have the financial capacity to drive Acosta Verde’s value creation by seizing investment opportunities. For this purpose, we are evaluating multiple options to grow the current portfolio and boost the Company’s profits. We expect to build brand recognition through the acquisition of new properties and an effective marketing strategy.

(1)Percentage of total revenue and NOI generated by the GLA owned by Acosta Verde and consolidated in the Company’s financial

statements

(2) Acosta Verde’s co-ownership share of each shopping center

Geographic Footprint

Grupo Acosta Verde develops its Sendero shopping centers in cities nearby and/or within manufacturing or service zones, which provide a high growth potential in terms of customers and visitor traffic.

As of December 31, 2021, the 18 assets comprising the Company’s Consolidated Portfolio are distributed in nine Mexican states, mainly in the northeast and northwest regions, as shown below:

Main Tenants

During 2021, a year marking the recovery of all economic sectors, the Sendero brand has continued to strengthen its strong and long-lasting relationships with its tenants, making communication its main tool for such purpose. Thanks to this approach, up to 50% of the GLA of each new project pre-leased.

Through these efforts, the Sendero Plazas stand out right from their opening by operating with a high occupancy levels and visitor traffic, as well as offering a diversified range of consumption and service choices for visitors. Aware of the importance of these relationships, year after year the Company allocates resources and time to strengthen its nationwide sales force to maintain continuous contact with each tenant and make them part of its main growth initiatives.

As for the prospection of new tenants as an ongoing process, once established in the shopping centers, they are closely follow-up to anticipate service requests and ensure future lease renewal on favorable terms for both parties.

These endeavors, carried out by a highly qualified and coordinated team, have contributed to the Company’s tenant base with a significant number of recurring tenants, those who operate in more than 6 of Acosta Verde’s shopping centers, and new prospects ranging from local to national chains.

Among Acosta Verde’s most renowned commercial partners are Cinépolis, Mexico’s leading movie theater operator, Liverpool, Mexico’s leading department store chain, whose Suburbia concept has been successfully integrated into selected Acosta Verde’s new developments, and Soriana, the country’s second largest supermarket chain.

Thanks to the ongoing efforts of its commercial team, Acosta Verde has successfully added several leading brands into its tenant base, such as Casa Ley (one of the leading supermarkets in the northwest region of Mexico), Merco, Smart, C&A, Happyland, Circus Park, SmartFit, Promoda, Miniso, Carl’s Jr, Starbucks, among others.

To continue consolidating the brand, the renewal and retention team closely monitors the lease expiration calendar, carrying out the necessary negotiations on dates close to expiration, with the purpose of achieving the highest renewal rate possible and increasing the lease spread (indicator that reflects the difference between the average rent price of a pool of renewed leases vs. the precedent average rent price of the same leases).

Characteristics of the Lease Contracts

For Acosta Verde, having a diversified lease portfolio by industry and location means offering the best experience to its visitors, as it ensures that their consumption, leisure, and service needs are covered.

In this regard, at the end of 2021, Acosta Verde’s Consolidated Lease Portfolio was comprised of approximately 1,690 contracts. On the other hand, leases of common spaces, which contribute the Company’s operating income, totaled 327.

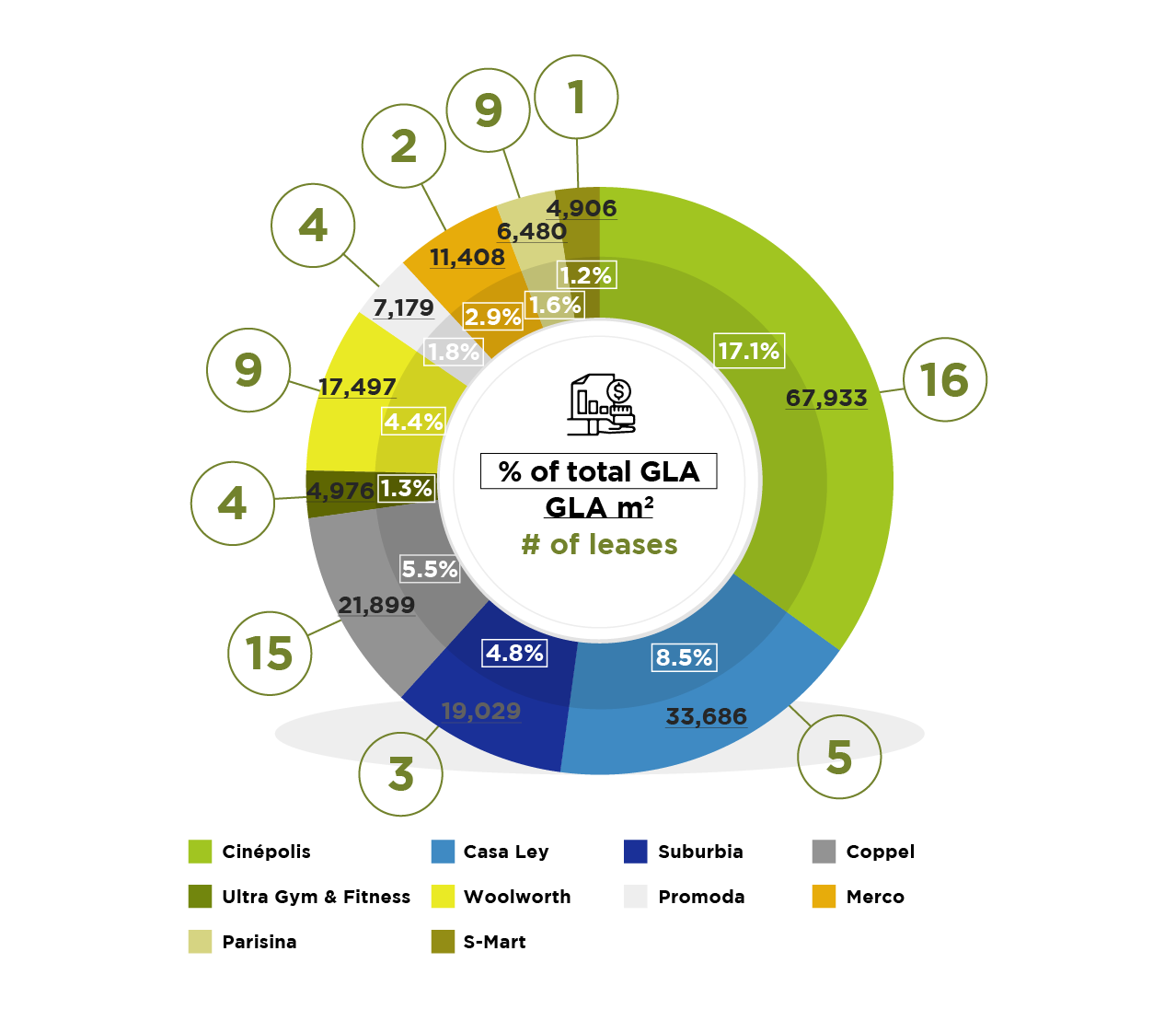

Our Top 10 Tenants by GLA

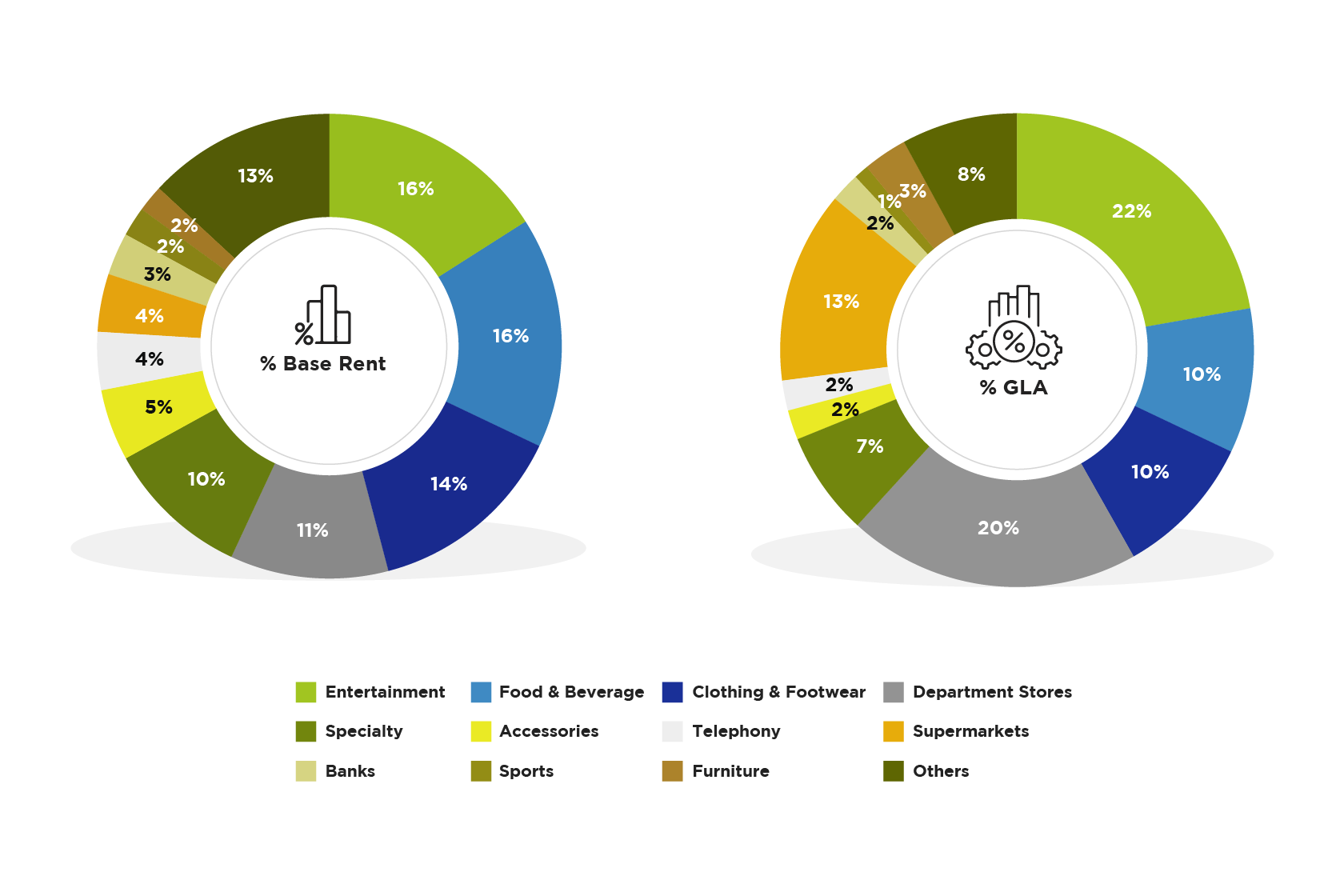

Lease Contracts Breakdown by Sector as a Percentage of GLA and Base Rent

Key Operating Metrics

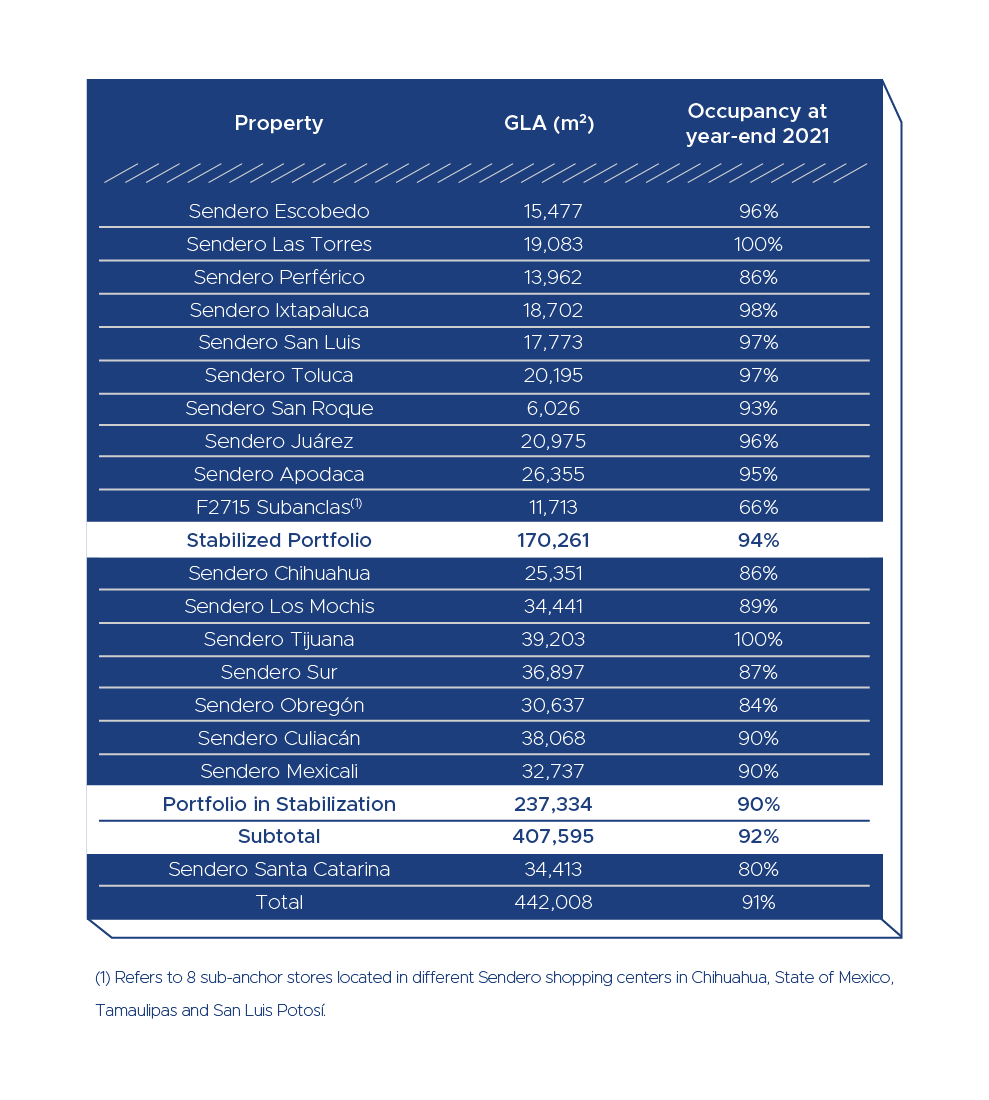

As of December 31, 2021, Acosta Verde’s operating portfolio consisted of 17 shopping malls developed and operated under the Community Center, the flagship format of the Sendero brand, of which 9 are stabilized (170,261 m2), 7 are in stabilization (237,334 m2) and including Sendero Santa Catarina (34,413 m2), which was inaugurated in March 2021.

The stabilized portfolio also includes eight subanchors acquired in 2017 through a trust (Trust identified as CIB 2715) whose premises are located within five of its shopping centers. Revenue from this trust is not consolidated in Acosta Verde’s financial statements and is recorded using the equity method (the Company’s stake is 50%).

Occupancy of the

Operating Portfolio

At the end of 2021, the occupancy of the operating portfolio was 90.7%, a slight decrease compared to 92.3% in 2020, mainly due to the difficult financial situation certain tenants faced, which did not allow them to renew their contracts, leading to a 2.8 pp. contraction in the occupancy of the stabilized portfolio.

In this context, it is important to highlight that Acosta Verde maintains close communication with its tenants to preserve its long-lasting business relationships, which helped to soften the impact of certain vacancies on same-property occupancy rate, which only decreased 0.7 pp.

Occupancy Breakdown by Property

Visitor and Vehicle Traffic

The easing of lockdown measures allowed businesses such as restaurants,

movie theaters and department stores to extend their opening hours and

increase their capacity to boost the Mexican economy.

As a result, during 2021, the number of visitors to Acosta Verde’s shopping

centers increased by 35% annually; however, it is important to note that in all the states where we operate, governmental restrictions continue to be

complied with in accordance with Mexico’s COVID-19 monitoring system.

On the other hand, vehicle traffic in parking lots totaled 19.1 million vehicles, an increase of 17.9% compared to 16.2 million vehicles in 2020. The annual comparison of vehicle traffic by quarter is presented below:

(millions of visitors)

% Ch. vs. same Quarter 2019

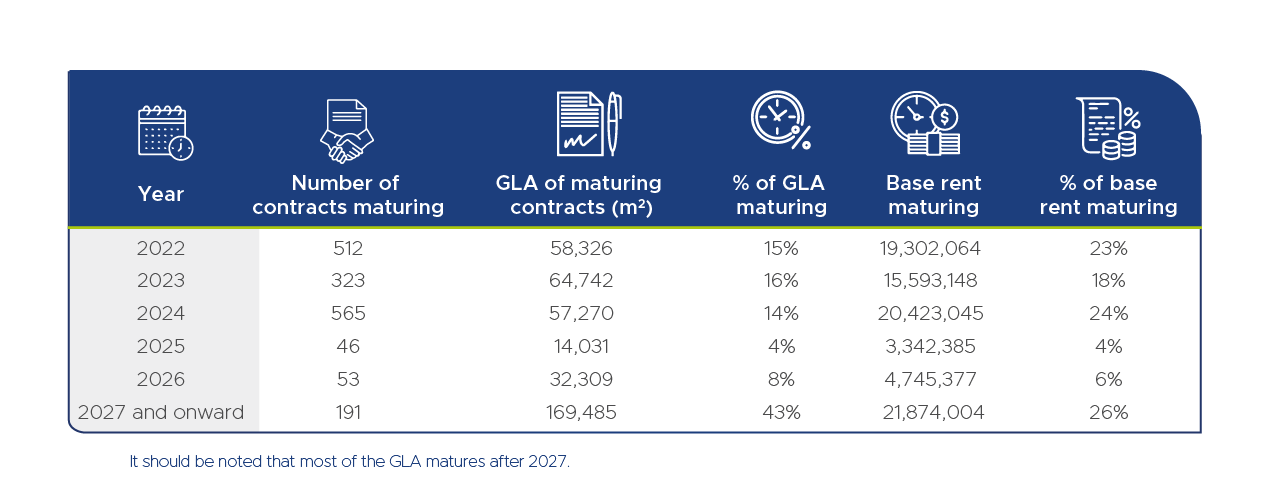

Contract Maturities

The maturities of the contracts at year-end 2021, both in terms of GLA and base rent, are summarized in the following table.

Lease Renewal and Lease Spread

During 2021, Acosta Verde successfully renewed 474 leases, equivalent to 64,713 m2 of GLA corresponding to the Operating Portfolio.

The Lease Spread for the year (indicator that reflects the difference between the average rent price of a pool of new leases compared to the preceding average rent price of the same leases) was 2.2%, taking using as a basis for comparison the 75,744 m2 renewed and replaced during 2021.

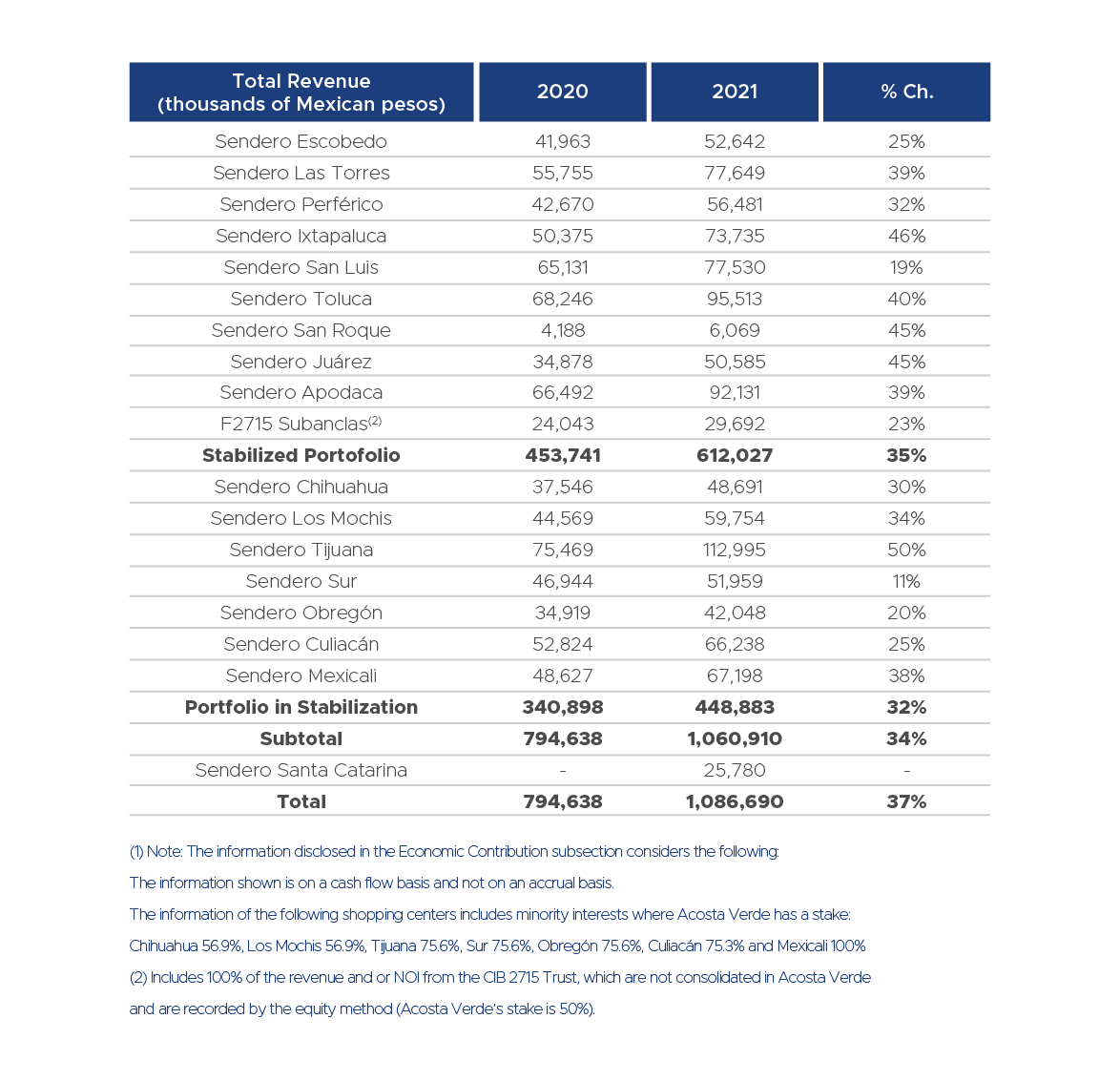

Economic Contribution(1)

Acosta Verde’s capacity to adapt and innovate led its operating properties to increase their economic contribution on an annual basis.

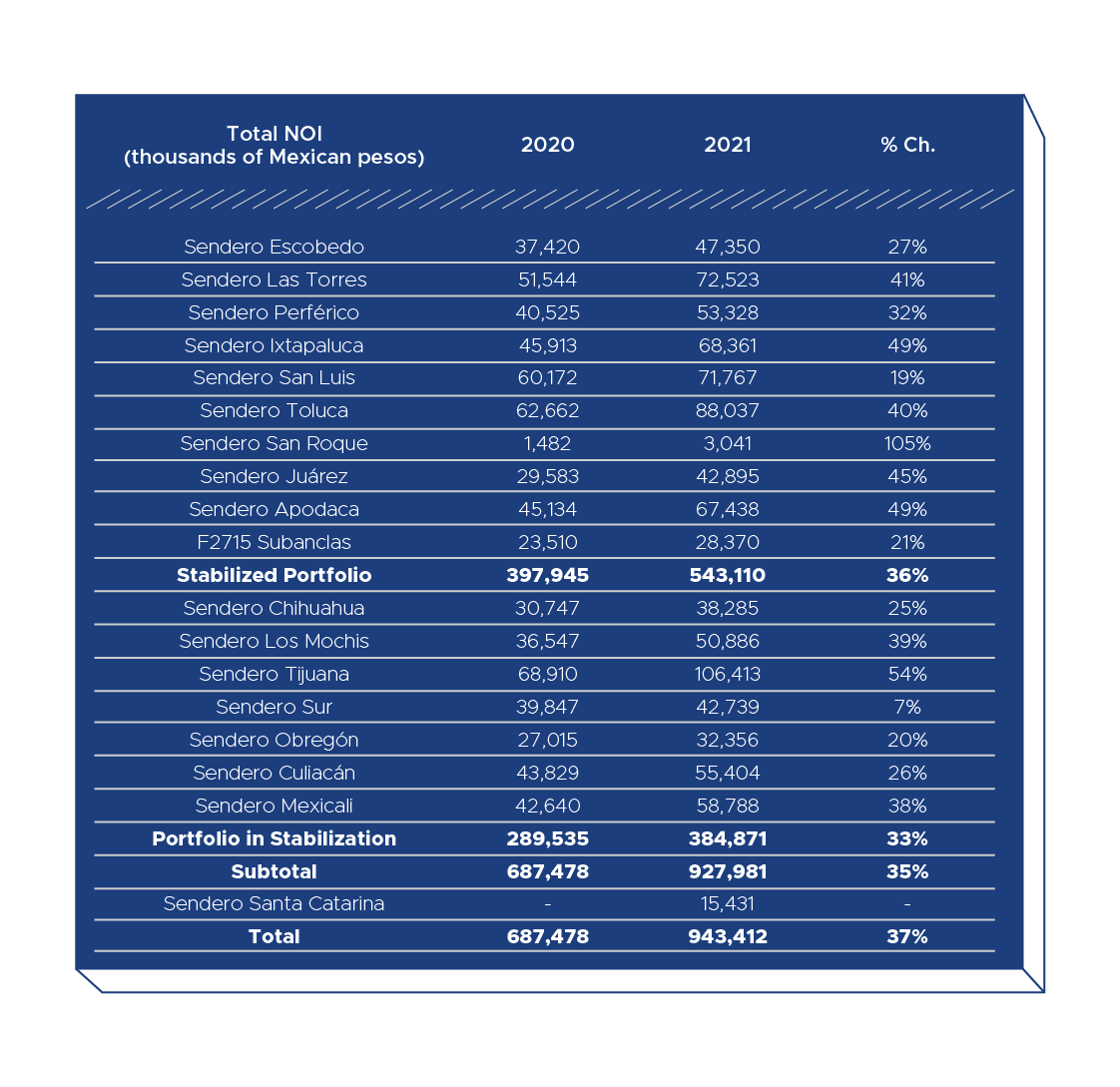

As of December 31, 2021, the portfolio’s financial results on a cash flow basis were as follows:

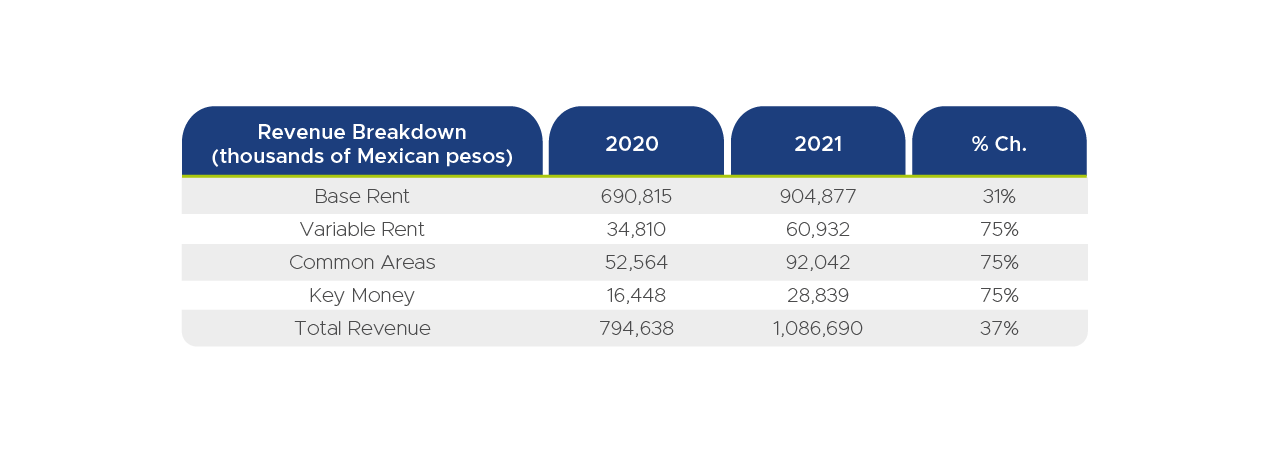

Revenue

The portfolio’s revenue are comprised of Base Rent, Variable Rent (% of sales), Common Areas (parking, advertising, common space rental) and Lease Fees.

Property Revenue

NOI

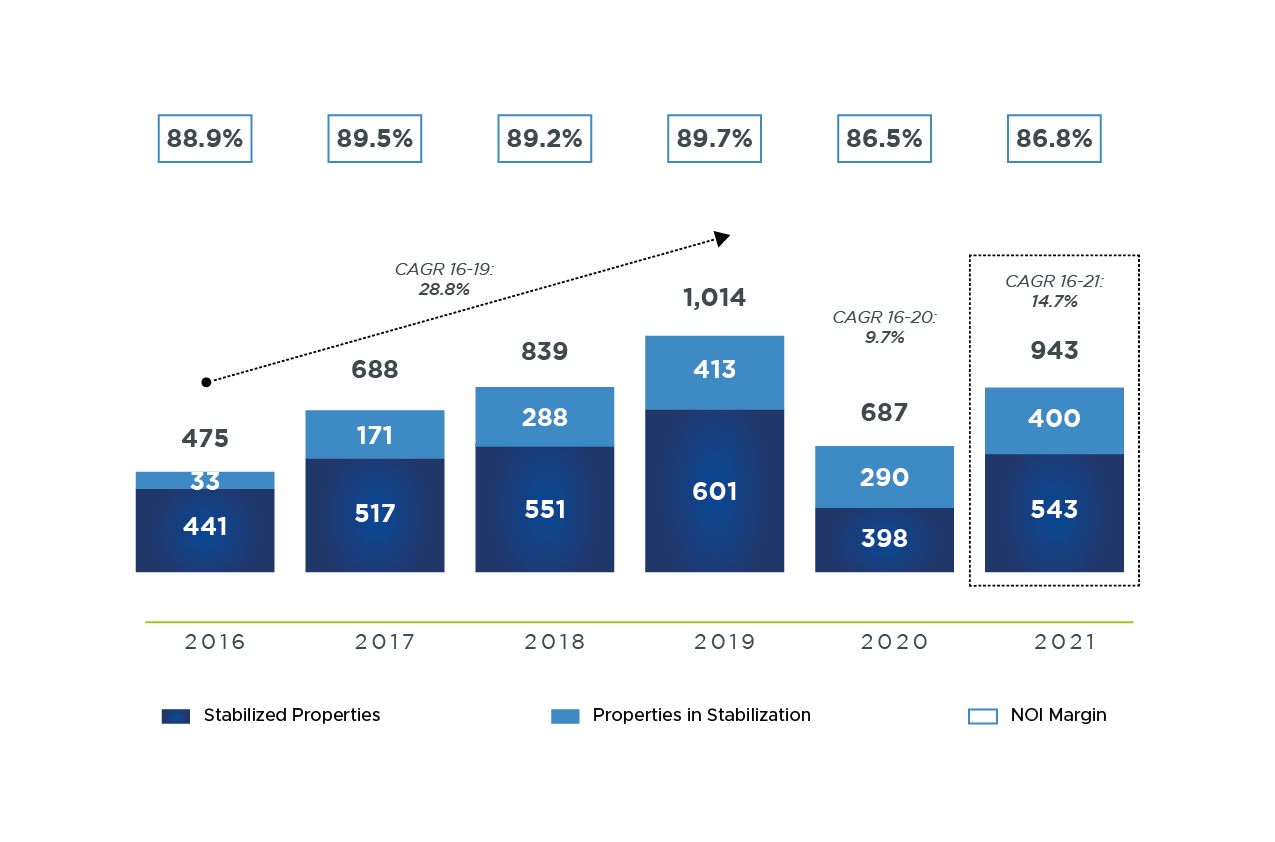

The following graph shows NOI evolution for 2016 - 2021 as well as NOI margin: